Wills and Estate Planning & Probate for Perth

Making or Writing a Perth Will for Perth Residents

Residents of Perth Urgently need to get their Perth Will Written or Updated

Did you know that that dying without a Will causes immense problems for your family?

Do you have a Will?

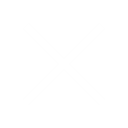

Surprisingly a massive 53% of the Western Australian population die without a Will or intestate and that includes people like you from Perth.

The trauma it causes to the remaining family members can be immense. With some family relationships permanently damaged for life that are never fixed as a result of no will or a poorly put together Will.

We come across stories weekly of the trauma and horror family members put each other through as a result of a loved one passing away without a Will.

Our job is to solve many of these problems for Perth families quickly and easily but we want you to know that they can be mostly avoided by making sure that you, your parents, your partner, your adult children and YOU most importantly have a Will.

Horror Will Story 1: Divorce and unexpected death with no updated Will

Mark and Amy were married for 15 years and had two children together, Felicity and Helen, before they divorced. Some years after her divorce, Amy began a relationship with Steve.

After living together for a couple of years, Amy and her partner Steve owned three properties as joint proprietors worth $2.2 million in total.

The only assets in Amy’s sole name were shares and a bank account collectively worth $435,000.

Amy sadly and unexpectedly passed away. She did not have a Will. If Amy had of know she was going to die, she probably would have organised a Will, but many times we see families where this is not organised even though their loved ones are sick.

You might not realise but If you do NOT have a Will, legislation determines who receives your assets after your death. Your estate will be distributed in accordance with intestacy laws from each state, which can have unintended consequences.

Under the intestacy provisions of the Administration and Probate Act, in Amy’s case…

- Her children Felicity and Helen received nothing from their mother’s deceased estate;

- and Steve was the sole beneficiary.

The situation above is not uncommon. Furthermore, there are numerous circumstances where the laws of intestacy may be inappropriate for you and your loved ones.

Note: Names have been changed.

Estate division for different children from different relationships

Another common situation is that you might want to divide your estate differently. Maybe you have both biological children and step kids that you want to provide for.

Children with disabilities who require long term support or leaving money to siblings can be specifically ensured within a Will.

If you have children that are minors, chances are you’d rather they receive their trust money in gradual disbursements, not all at once when they turn 18.

You can address any of these scenarios in your Will. However, without a Will the money that you wanted to go to your disabled child might not get divvied up that way.

In the event your children need financial assistance from you, they will inevitably need it upon your death.

Horror Will Story 2: A lack of a Will destroys sibling relationships

For one man his father’s death (without a Will) lead to massive sibling arguments, threats and an all-out family war. This was over the deceased father’s large farm estate.

The son working on the farm went to court to win the case to keep the farm which deprived the other siblings of their share of the estate.

This led family members to seek revenge and lead to years of malicious activity. False family secrets were anonymously shared with work colleagues and close friends of the man. These resulted in distrust and broken relationships as well as work problems.

So, because his father had not carefully thought about his Will and how to protect all his children, he unknowingly destroyed his families bonds.

Ask yourself if this is what could happen to your family, should you die without a Will?

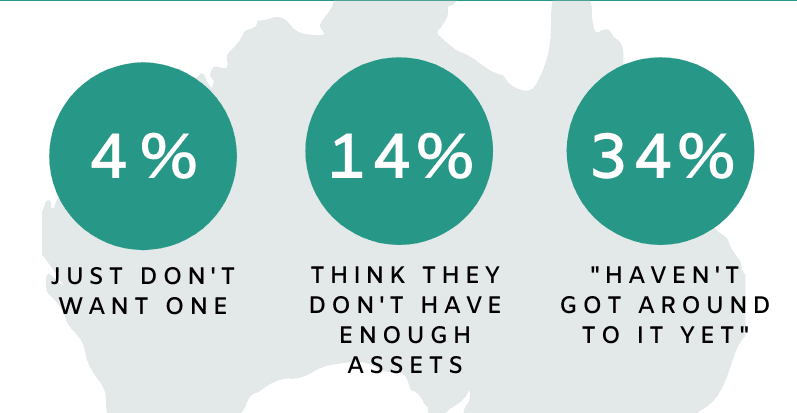

Horror Will Story 3: A series of events leaves loved granddaughter and her father’s relationship ruined.

John who was very close to his only grandchild wished to leave part of his estate to her. John and his granddaughter spent a lot of time together and he promised her that one day she would benefit from his hard-earned wealth.

He explained that he was leaving his estate to his only child, her mother, who would eventually pass it on to her.

The plan was on track. When he died, the girl’s mother inherited everything. But shortly afterwards, her mother died suddenly. The inheritance went to her husband, the girl’s father remarried a few years later.

That’s where things went awry. The girl, now an adult, asked her father for some of her grandfather’s money so she could start a business. He refused, saying he needed the money to buy a house for his new wife and stepchildren and to pay for their education.

She argued that her grandfather had promised her the money, but the father refused to budge, insisting, “it’s my money now.” That was the last time the girl ever spoke to her father.

If the grandfather had left a trust for his granddaughter, so that when she came of age the money was available to her and her alone, then the relationship between the granddaughter and her father would still be in tact.

As these three real stories show you, it is not uncommon, sadly, for unexpected deaths and no one is immune to death.

You might think now that your family gets along just fine and that they can handle the division of estates. However, this is not always the case and it is better to avoid long court battles by not only having a Will, but updating it when necessary.

Covid-19 Impact

All Australians should be willing to face their mortality as Western Australia navigates the Covid-19 Pandemic and should work to have a plan in the event they pass.

This should be whether you are 18 years or 81 years old. Clairs Keeley Lawyers are Will specialists and deal with writing up Wills, dealing with Will Disputes, Probate and more. We can offer you advice over the phone, via video conference or over emails if possible to help you organise your Will.

We recommend that it is important to review your enduring powers of attorney and guardianship documents and contact us if you require new documents drafted. Again, we can provide a virtual service for these documents along with other estate planning documents, or we can meet up at our offices.

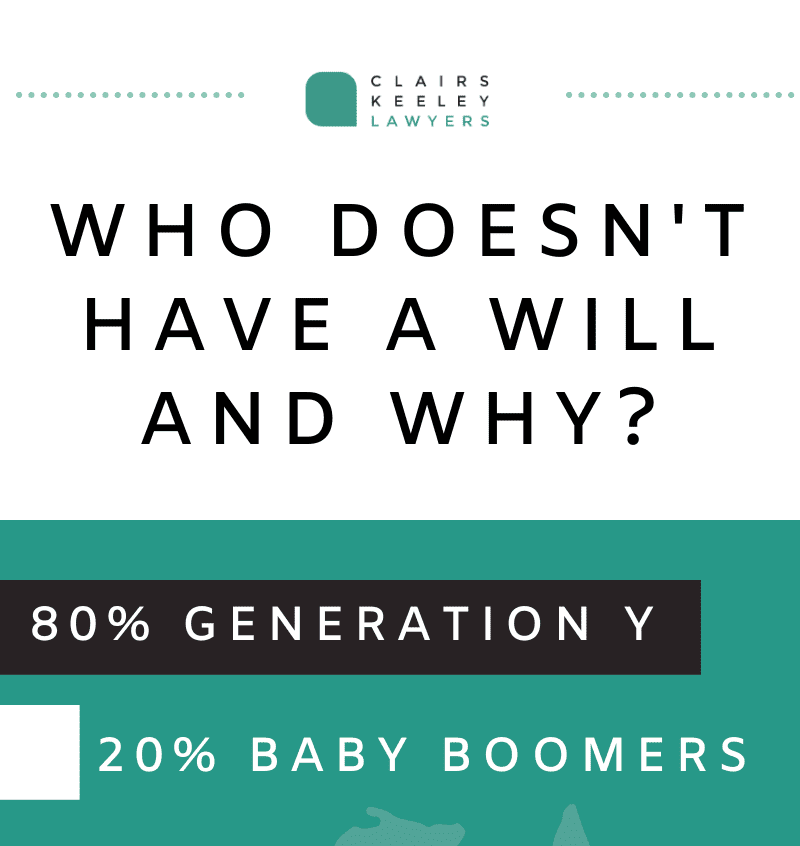

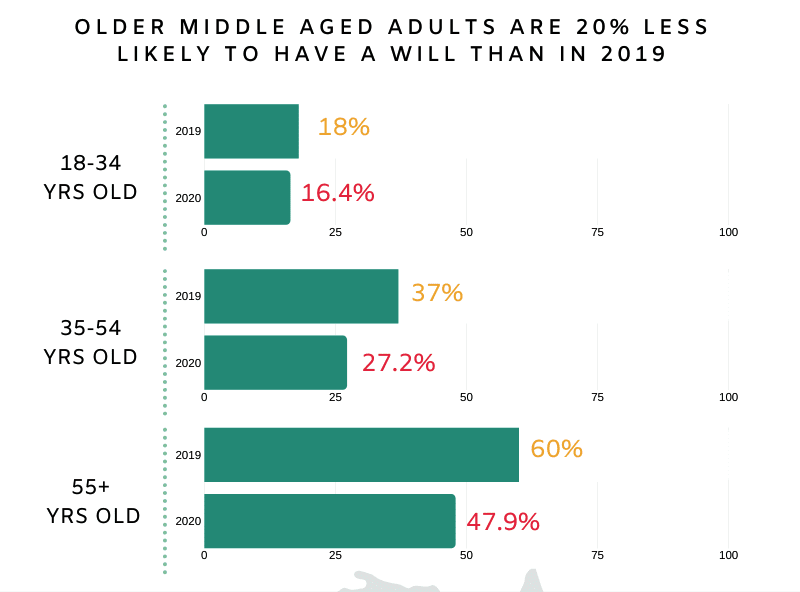

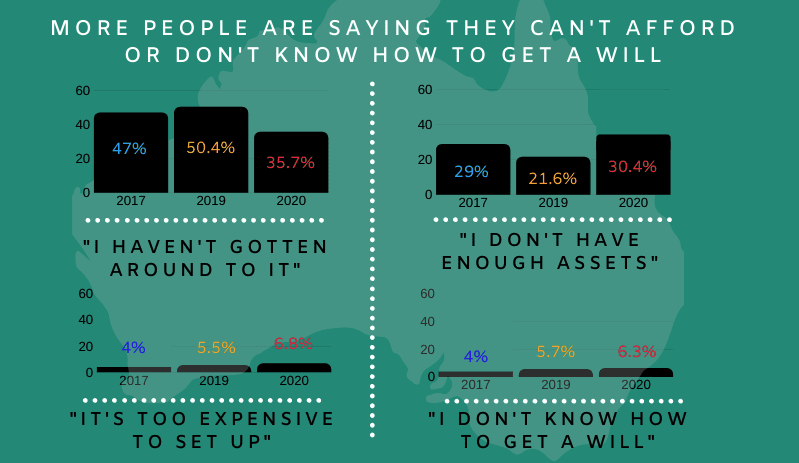

In the last three years the amount of Australians getting a Will organised is getting lower, and surprisingly the rate of people stating their reasoning as “not knowing how to” has increased! Have you ever asked the question “how do I set up a Will?” Well, we can help.

A simple phone call or an email will hopefully put your mind at ease and let you know that the process is not as scary as many Australians think it is.

The first step is easy, contact a professional. A trusted and experienced Perth Wills and Estate Lawyer can walk you through the steps and help you write your Will. This is the most time effective way as they know what is legally required.

A lawyer can talk you through anything you might be unsure of such as “can I include XYZ or what will happen to my pets when I die?” Never be afraid to ask questions as this is how you can ensure your Will suits your needs and this is what the lawyers are there to help you with.

Our estate planning meetings usually last for 60 minutes. We understand that some of our clients like to know the types of questions they will be asked before they attend their appointment.

Our lawyers will ask you about your finances, your family situation, your health, and what you want to include in your will. Family trusts or a self-managed super fund will require a copy of the trust deed and any amending deed.

Questions you will be asked include do you have the following:

- A Will

- Power of Attorney

- Enduring Power of Attorney

- Enduring Power of Guardianship

- Advance Health Directive

Please bring those documents to your first meeting if you have them. If you don’t yet have any of the documents, let us take the mystery out them for you.

After we have taken your instructions and gained an understanding of your financial and family situation we will advise you on the appropriate documents required to create your estate plan.

We will also give you a fixed price which will be dependent on the type of documents required to distribute your assets according to your wishes in the most tax-effective way possible.

Other Wills and Estate Services that we specialise in:

Family law in Perth Services:

Some Business Property Services for Perth

Our Multi-Disciplinary Team Can Also Assist With

Family Dispute Resolution Perth

Family Law Mediation Perth

Wills and Estate Planning Perth

Probate Lawyer Perth

Perth Property Lawyer

Family Lawyer Perth

General Perth Family Law Issues

Contact Us

Clairs Keeley Lawyers are specialist Will Lawyers for Families from Perth to Perth and all across WA.

Please phone on (08) 9228 0811 or email us (Fill in the form on this page) to get quality advice.